On May 22, 2025, H100 Group AB, a Swedish health tech firm, made history by purchasing 4.39 Bitcoins for $490,830, becoming Sweden’s first publicly listed company with a Bitcoin treasury strategy. The acquisition, at an average price of $111,785 per BTC, sent H100’s shares soaring 39.27% to 1.22 SEK ($0.13), boosting its market value to $14.84 million, per Crypto News. CEO Sander Andersen called Bitcoin a “resilient long-term asset,” aligning with H100’s focus on individual sovereignty and preventive healthcare.

This move mirrors global trends, with 109 public firms, like MicroStrategy, holding Bitcoin to hedge inflation, per BitcoinTreasuries.NET. Bitcoin’s rally past $111,000, fueled by U.S. ETF inflows and pro-crypto policies, adds momentum. Swedish lawmakers’ push for a national Bitcoin reserve further supports H100’s strategy.

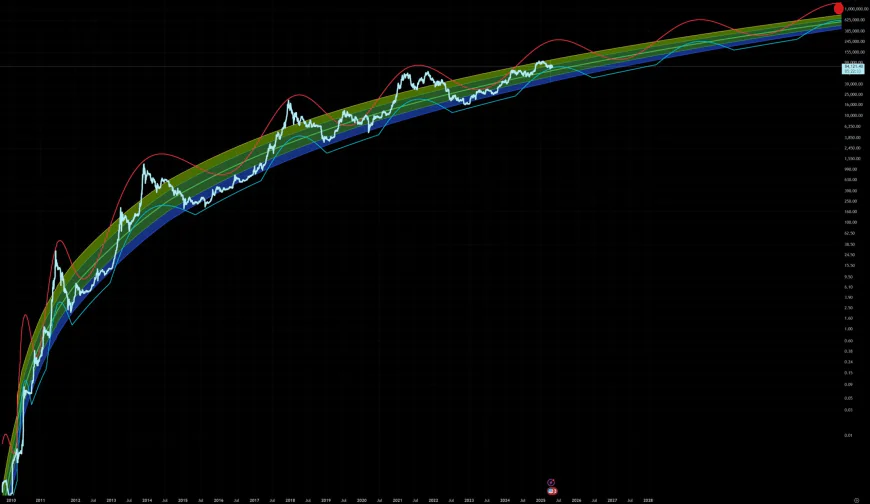

For new investors, H100’s surge highlights Bitcoin’s growing corporate appeal, but volatility risks—seen in BTC’s $70,000–$112,000 swings—loom large. Regulatory uncertainty could also impact future gains. While H100 sets a bold precedent, beginners should diversify and monitor market trends to navigate this high-stakes crypto wave safely.

NOTICE:

The information provided on trafy.io does not constitute investment advice or recommendations. All investment and trading activities involve risks, and readers are advised to conduct their own research before making decisions.

NOTICE:

The information provided on trafy.io does not constitute investment advice or recommendations. All investment and trading activities involve risks, and readers are advised to conduct their own research before making decisions.