Bitcoin Halving Crushes Hut 8: $134M Loss Signals Miner Meltdown?

Hut 8 reports a $134M loss in Q1 2025 as Bitcoin halving slashes rewards. Can its 79% hashrate boost save the day? Dive in!

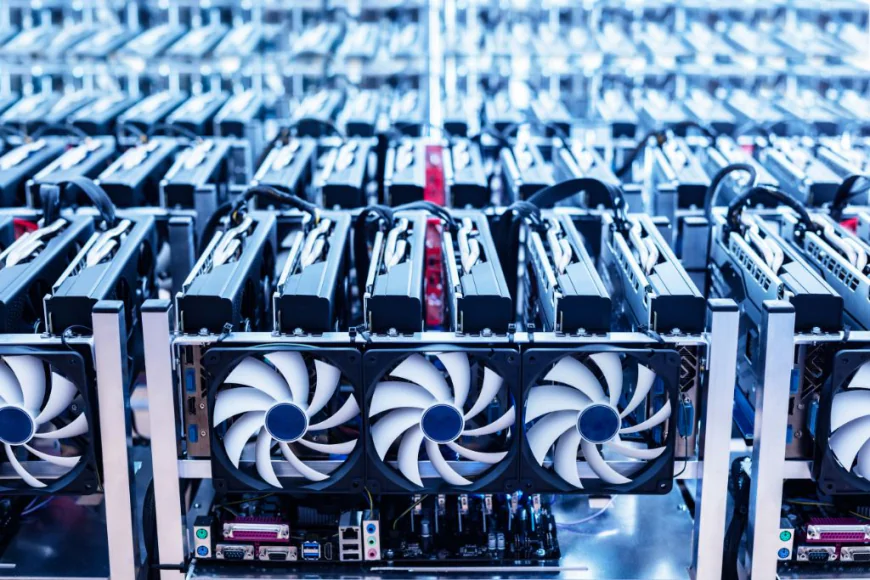

The Bitcoin halving, a programmed event every four years, reduced block rewards from 6.25 to 3.125 BTC, squeezing miners’ income. Hut 8’s loss was amplified by a $112 million markdown on its 10,264 BTC treasury due 10,264 BTC holdings, as Bitcoin fell $11,000 per coin in Q1. Despite the financial hit, Hut 8 boosted its hashrate by 79% with an ASIC fleet upgrade and improved fleet efficiency by 37%.

The halving has exposed the mining sector’s vulnerability, with firms like Marathon Digital also reporting losses. Hut 8’s robust Bitcoin reserve, valued at roughly $1 billion, offers a buffer, but declining miner reserves signal industry-wide pressure. The company’s expansion plans, targeting 2,600 MW capacity, could strengthen its position, but high energy costs and market volatility remain risks. If Bitcoin sustains its $100,000 level, miners could recover, but a dip could deepen losses.

Hut 8’s focus on efficiency and expansion, including American Bitcoin, aims to offset halving impacts. If Bitcoin rallies to $105,000, as some predict, Hut 8’s treasury could swell, easing financial strain. However, token unlocks or tariff-related market dips could exacerbate losses, with $44.95 million in long liquidations at $94,500.